Our Mission

At ElderSecure Plans, our mission is to provide comprehensive, compassionate, and personalized financial security solutions for seniors and their families. We believe every individual deserves dignity, stability, and peace of mind during their golden years.

Our core values guide everything we do:

- Integrity: We maintain the highest ethical standards in all our dealings

- Compassion: We approach every situation with empathy and understanding

- Expertise: We bring decades of specialized knowledge to every client

- Personalization: We create tailored solutions for each unique situation

- Transparency: We believe in clear communication and honest advice

Our History

ElderSecure Plans was founded in 2005 by financial advisor Michael Reynolds after witnessing firsthand the challenges his own parents faced navigating retirement planning and long-term care options.

What began as a small consultancy focused on senior financial security has grown into a nationally recognized firm with offices in five states, serving thousands of clients annually.

Key Milestones

-

2005

Company founded in Boston, MA with three employees

-

2010

Expanded services to include comprehensive estate planning

-

2015

Recognized as "Top Senior Financial Services Provider" by Financial Times

-

2020

Launched our innovative digital planning platform

Meet Our Team

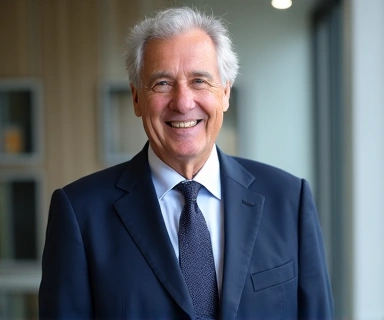

Michael Reynolds

Founder & CEO

With over 30 years in financial planning, Michael brings unparalleled expertise in retirement strategies and wealth preservation for seniors.

Sarah Chen

Chief Financial Officer

Sarah oversees all financial operations and brings 20 years of experience in wealth management and tax optimization strategies.

David Rodriguez

Director of Client Services

David leads our client relations team and specializes in creating customized care plans that address both financial and emotional needs.

Emily Park

Senior Financial Advisor

Emily specializes in estate planning and intergenerational wealth transfer, helping families preserve their legacies.

Robert Johnson

Medicare Specialist

With 25 years in healthcare finance, Robert helps clients navigate the complex world of Medicare and long-term care insurance.

Lisa Wong

Client Care Coordinator

Lisa ensures every client receives personalized attention and coordinates between families, advisors, and care providers.

Our Approach

At ElderSecure Plans, we take a holistic approach to senior financial security that goes beyond traditional financial planning. We understand that financial decisions in later life are deeply personal and often emotional.

Comprehensive Assessment

We begin with a thorough evaluation of your current financial situation, health status, family dynamics, and long-term goals. This 360-degree view allows us to identify potential risks and opportunities.

Customized Solutions

No two clients are alike. We develop tailored strategies that address your unique circumstances, preferences, and values, ensuring your plan evolves with your changing needs.

Ongoing Support

Our relationship doesn't end with a plan. We provide continuous monitoring, regular check-ins, and adjustments as needed to keep your strategy aligned with your goals.

Family Involvement

We facilitate family meetings and create clear documentation to ensure your loved ones understand your wishes and can support your decisions.

Community Involvement

Beyond serving our clients, we're committed to making a difference in the communities where we live and work. ElderSecure Plans actively supports initiatives that improve the lives of seniors and their caregivers.

Our Initiatives Include:

- Financial literacy workshops for seniors at local community centers

- Sponsorship of caregiver support programs

- Pro bono planning services for low-income seniors

- Partnerships with Alzheimer's research organizations

- Annual scholarship for students pursuing gerontology degrees